CAR TITLE LOANS ONLINE

Now it’s easier than ever to apply for a car title loan online. 1 (800) Car-Title® makes it easy to start the application process online and save time by providing initial information before you speak to a Loan Officer. The car title loan online application is easy and simple!

- Fill out the form to the right which will give us your contact information and vehicle information

- Fill out the additional details page that will make it easier for us to process your online application

- You will be contacted by one of our loan officers in a matter of minutes

- Submit all necessary documents online

- Get approved and get your cash

When you’re strapped for cash and can’t pay your bills, the lack of financial control can feel frustrating and add stress to an already overwhelming situation. If you think that your situation is hopeless, there are various options to get the money that you need. One of those options is applying for an online title loan.

If you’ve been turned down for other types of loans, taking out a title loan may be a great way to get some cash quickly. A title loan uses the value of your car as the collateral for your loan. You could potentially borrow up to the full value of your vehicle and depending on how much you owe on that vehicle, access that cash. In many cases you can get your cash the same day that you apply. And loans are available for all levels of creditworthiness.

When you take out a title loan, the lender will place a lien against your car. You still drive your car, but the lien gives the lender the collateral to secure your loan. If you make payments on time, the car’s ownership will never change hands. Once the loan is paid off, the lender will remove the lien.

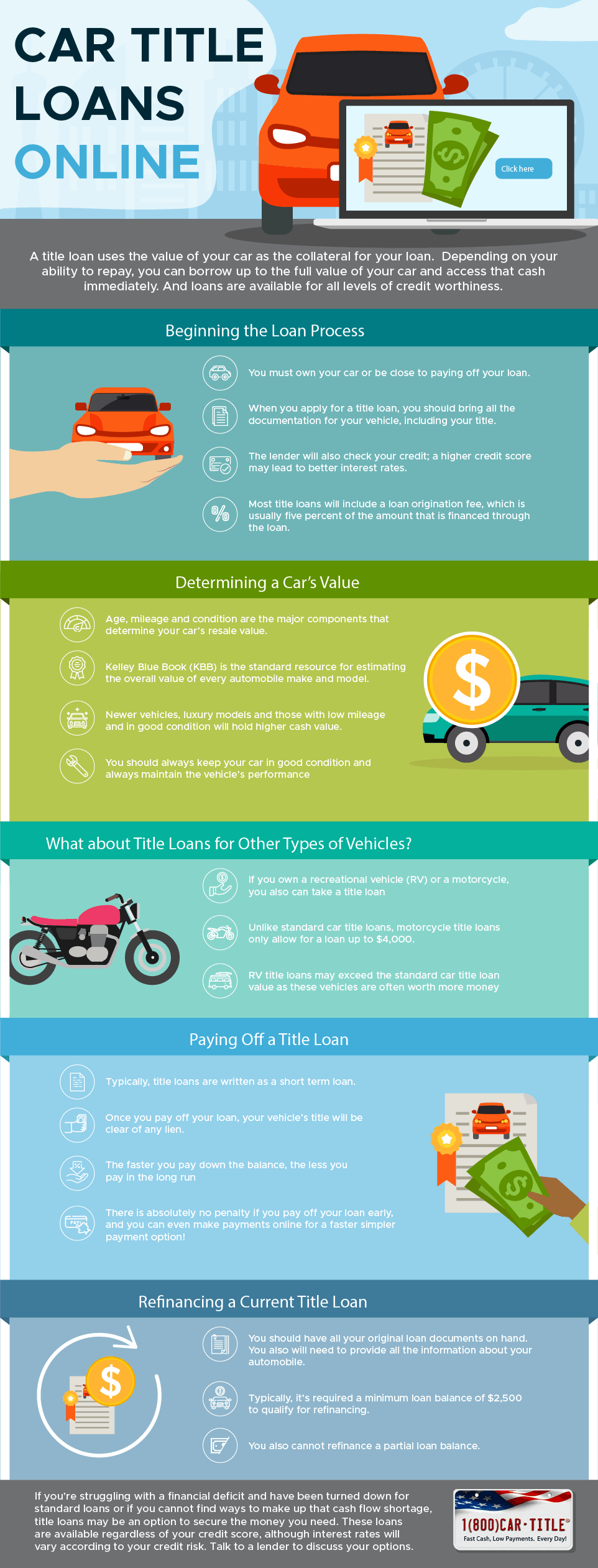

Beginning the Loan Process

At LoanCenter, we understand that people are busy, so we created our online application process. If you’re wondering how you can qualify for a car title loan online, it’s quite simple. To start, all you need to do is apply on the online title loan form at the top of this page. After you finish the application, an experienced loan officer will contact you shortly to complete the process and answer any questions you may have. You can even upload required documents and files through your phone. It’s that easy!

An important requirement is that you must own your car or be close to paying off your loan. You cannot have a significantly large outstanding loan balance, and your car’s title cannot have any other liens on it. When you apply for a title loan, you should have all the documentation for your vehicle, including having your title available. The lender also will check your credit. While you may still qualify with bad credit, a higher credit score can get you better terms on your loan, such as borrowing a larger amount of money, getting a lower APR, or having lower monthly payments.

Determining a Car’s Value

There are many factors that affect your car’s net worth. Age, mileage and condition are the major components that determine your car’s resale value. Kelley Blue Book (KBB) is one of the standard resources for estimating the overall value of every automobile make and model, and the KBB price helps lenders set the loan valuation for title loans.

Newer vehicles, luxury models and those with low mileage and in good condition will hold higher cash value. You should always keep your car in good condition and always maintain the vehicle’s performance, because your car is one of the largest assets that most people own. You never know when you may need to trade-in, sell or even take a loan against your automobile. While you cannot change the make, mileage or age of this asset, you can take control of the vehicle’s appearance and mechanics.

What about Title Loans for Other Types of Vehicles?

If you own a recreational vehicle (RV) or a motorcycle, you also can take out a title loan. In fact, some individuals prefer to use a secondary vehicle like an RV or motorcycle for their title loan, as it ensures that their primary vehicle remains lien free. RV title loans may exceed the standard car title loan value as these vehicles are often worth more money. If you want to apply for an RV Title loan on our website click here. Click the following link if you want to apply online for a motorcycle title loan.

Paying Off a Title Loan

Once you get your cash, LoanCenter makes it easy to make your payments. Once you pay off your loan, your vehicle’s title will be clear of any lien. And the faster you pay down the balance, the less you pay in the long run. There is absolutely no penalty if you pay off your loan early, and you can even make payments online for a faster simpler payment option!

If you’re struggling with a financial deficit and have been turned down for standard loans or if you cannot find ways to make up that cash flow shortage, title loans may be an option to secure the money you need. These loans are available regardless of your credit score, although interest rates will vary according to your credit risk. Talk to a lender to discuss your options.

More Resources

- Refinance Title Loan

- Get Your Quote Today

- California Car Title Loans

- Georgia Car Title Loans

- How Car Title Loans Work?

- Locations

- Home

- Pink Slip Loans

- Can I Get a Title Loan with an Old Car?

- Sacramento Car Title Loan

- Title Loans ins St Louis

- Fresno Car Title Loans

- Our Community Service

- Arizona Car Title Loans

- Payday Loans vs Title Loans

- Title Loan Options

- How Title Loans Improve your Credit?

- Prestamos Sobre Titulo de Auto

- RV Title Loans

- Salt Lake City Car Title Loans

- Bakersfield Car Title Loans

- Idaho Car Title Loans

- WCC Teams Up with Moneygram

- Our Programs

HOW MUCH IS MY CAR WORTH?