Vehicle Title Loans Near Me: How Much Can I Borrow?

By Marcela De Vivo • June 27, 2022

Life is unpredictable. Even if you’ve carefully prepared a budget, additional expenses can arise as a result of car accidents, home repairs, medical emergencies, or other unexpected situations. If you need extra cash to cover unexpected expenses like these, it’s important to explore all of your options, including vehicle title loans.

Vehicle title loans are not like traditional personal loans. A title loan is secured by the title to your vehicle. In other words, if you want to borrow money through a title loan, you must use the title to your vehicle as collateral. You can still drive your car even though you are using it to secure your loan. Your lender will put a lien on your title until your loan has been paid off, at which point the lien will be removed.

Before you start searching for “vehicle title loans near me,” it’s important to determine if applying for a title loan will provide you with enough cash to make ends meet. How much can you borrow through a title loan? Here’s what you need to know:

What Factors Will Impact How Much I Can Borrow Through A Title Loan?

Title loan amounts can range from $2,000 to $50,000. Your title loan company will consider a number of factors when determining how much you can borrow, including:

- Your Income

- Type of Vehicle

- Your Vehicle’s Resale Value

- Your Equity

- State Laws

Your Income

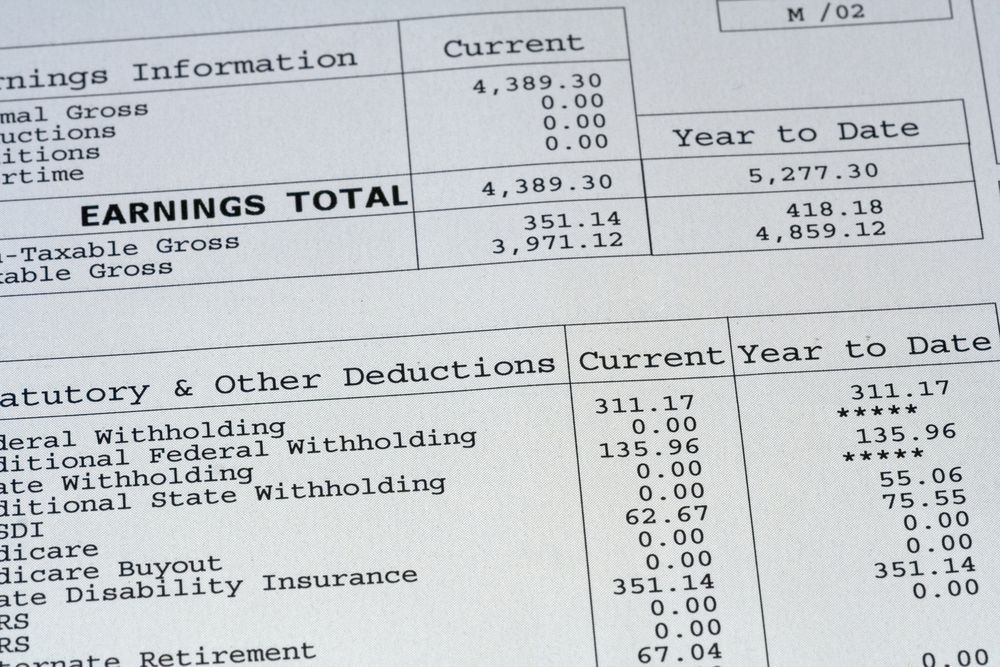

During the application process, your title loan company will ask you to submit proof of income. Examples of acceptable forms of proof of income may include recent pay stubs, bank statements, or tax returns. Submitting these documents allows the title loan company to confirm you have a reliable source of income that can be used to repay the money you borrow.

It also gives the title loan company an opportunity to assess your income to determine how much you can afford to repay. The results of this assessment could impact how much you are approved to borrow.

Type of Vehicle

The type of vehicle you use as collateral to secure your title loan could impact how much you can borrow.

Most title loan companies accept a wide range of vehicles as collateral, including:

- Sedans

- Coupes

- Convertibles

- SUVs

- Pickup trucks

- Minivans

- Motorcycles

- RVs

However, there are lending caps associated with some types of vehicles. For instance, there is a $4,000 cap on title loans secured by motorcycles. If you need more than $4,000, you may want to use your personal vehicle instead of your motorcycle to secure your title loan.

Other vehicles, such as RVs, are worth more, which means you may be able to borrow more if you are approved for a title loan. Keep this in mind if you own multiple vehicles and can’t decide which one to use as collateral.

Your Vehicle’s Resale Value

Remember, the title to your vehicle is used as collateral to support your title loan. Because of this, the title loan company must know how much your vehicle is worth before deciding if you are eligible for a title loan and if so, how much you can borrow.

During the application process, the title loan company may ask you to either bring your vehicle in for an inspection or submit photographs of your vehicle. This gives the title loan company an opportunity to examine your vehicle and calculate its resale value.

Several factors can impact your vehicle’s resale value, including its make, model, year, mileage, condition, and trim level. Once your vehicle’s resale value has been calculated, you will have a better idea of how much you will be able to borrow. You cannot borrow more than the value of your vehicle. In fact, most title loan companies will only allow you to borrow up to a certain percentage of your vehicle’s value.

Your Equity

You must have equity in your vehicle to qualify for a title loan. The value of this equity in your vehicle is another factor that can impact how much you are able to borrow through a title loan.

To calculate your equity, subtract the amount you owe on your vehicle from your vehicle’s resale value. For example, if you owe $3,000 on a vehicle that is worth $10,000, this means you have $7,000 of equity ($10,000-$3,000=$7,000). You cannot borrow more than the value of your equity in your vehicle.

If you have negative equity, which means you owe more than the vehicle is worth, you cannot use this vehicle to secure your title loan. For example, if your vehicle is worth $8,000 but you owe $9,000 on it, you have negative equity and cannot use this title as collateral for your title loan.

State Laws

Where you live may also impact how much you are able to borrow through a title loan. This is because some states have passed laws that establish minimum and maximum title loan amounts. Title loan companies must comply with these laws when lending to residents of these states.

For example, the state of Illinois limits each title loan to a maximum of $4,000 or 50% of the borrower’s monthly income. In Mississippi, title loan companies cannot issue title loans that exceed $2,500. Title loan companies in New Hampshire, on the other hand, can issue up to $10,000 per title loan.

If you live in a state with these laws, they could limit how much you are able to borrow. If you’re not sure whether your state has these laws, check with your title loan company or do your own research to find out.

All of these factors will impact how much you are approved to borrow from your title loan company. Fortunately, it only takes a few minutes to find out how much you can borrow. All you need to do is call your title loan company and ask for a free quote.

How to Apply for Vehicle Title Loans Near Me

Now you should have a better idea of whether you will be able to get the cash you need by applying for a title loan. If you’re ready to move forward, follow these steps to apply for a title loan from 1(800)CAR-TITLE®:

- Contact our loan specialists. You can call 1-800-227-8485 to speak to a loan specialist directly. You can also submit your information using the form on our website and wait for a loan specialist to get in touch with you.

- Get a free quote. Your loan specialist will need some information about your vehicle to prepare your free quote. Be prepared to provide your vehicle’s make, model, year, mileage, condition, and trim level. Then, review the terms of your free quote with your loan specialist.

- Finalize your loan. If you’re happy with the terms of your quote, finalize your loan by signing and submitting the required documentation. Your loan specialist will guide you through this step to ensure you understand what needs to be signed and submitted.

- Collect your cash. Your money will be available shortly after your application is processed and approved. Pick up your cash in person or have it sent to you via check or wire transfer.

The title loan application process is simple and straightforward. The sooner you start your application, the sooner you can get the cash you need to make ends meet.

Your Income

During the application process, your title loan company will ask you to submit proof of income. Examples of acceptable forms of proof of income may include recent pay stubs, bank statements, or tax returns. Submitting these documents allows the title loan company to confirm you have a reliable source of income that can be used to repay the money you borrow.

It also gives the title loan company an opportunity to assess your income to determine how much you can afford to repay. The results of this assessment could impact how much you are approved to borrow.

Type of Vehicle

The type of vehicle you use as collateral to secure your title loan could impact how much you can borrow.

Most title loan companies accept a wide range of vehicles as collateral, including:

- Sedans

- Coupes

- Convertibles

- SUVs

- Pickup trucks

- Minivans

- Motorcycles

- RVs

However, there are lending caps associated with some types of vehicles. For instance, there is a $4,000 cap on title loans secured by motorcycles. If you need more than $4,000, you may want to use your personal vehicle instead of your motorcycle to secure your title loan.

Other vehicles, such as RVs, are worth more, which means you may be able to borrow more if you are approved for a title loan. Keep this in mind if you own multiple vehicles and can’t decide which one to use as collateral.

Your Vehicle’s Resale Value

Remember, the title to your vehicle is used as collateral to support your title loan. Because of this, the title loan company must know how much your vehicle is worth before deciding if you are eligible for a title loan and if so, how much you can borrow.

During the application process, the title loan company may ask you to either bring your vehicle in for an inspection or submit photographs of your vehicle. This gives the title loan company an opportunity to examine your vehicle and calculate its resale value.

Several factors can impact your vehicle’s resale value, including its make, model, year, mileage, condition, and trim level. Once your vehicle’s resale value has been calculated, you will have a better idea of how much you will be able to borrow. You cannot borrow more than the value of your vehicle. In fact, most title loan companies will only allow you to borrow up to a certain percentage of your vehicle’s value.

Your Equity

You must have equity in your vehicle to qualify for a title loan. The value of this equity in your vehicle is another factor that can impact how much you are able to borrow through a title loan.

To calculate your equity, subtract the amount you owe on your vehicle from your vehicle’s resale value. For example, if you owe $3,000 on a vehicle that is worth $10,000, this means you have $7,000 of equity ($10,000-$3,000=$7,000). You cannot borrow more than the value of your equity in your vehicle.

If you have negative equity, which means you owe more than the vehicle is worth, you cannot use this vehicle to secure your title loan. For example, if your vehicle is worth $8,000 but you owe $9,000 on it, you have negative equity and cannot use this title as collateral for your title loan.

State Laws

Where you live may also impact how much you are able to borrow through a title loan. This is because some states have passed laws that establish minimum and maximum title loan amounts. Title loan companies must comply with these laws when lending to residents of these states.

For example, the state of Illinois limits each title loan to a maximum of $4,000 or 50% of the borrower’s monthly income. In Mississippi, title loan companies cannot issue title loans that exceed $2,500. Title loan companies in New Hampshire, on the other hand, can issue up to $10,000 per title loan.

If you live in a state with these laws, they could limit how much you are able to borrow. If you’re not sure whether your state has these laws, check with your title loan company or do your own research to find out.

All of these factors will impact how much you are approved to borrow from your title loan company. Fortunately, it only takes a few minutes to find out how much you can borrow. All you need to do is call your title loan company and ask for a free quote.

How to Apply for Vehicle Title Loans Near Me

Now you should have a better idea of whether you will be able to get the cash you need by applying for a title loan. If you’re ready to move forward, follow these steps to apply for a title loan from 1(800)CAR-TITLE®:

- Contact our loan specialists. You can call 1-800-227-8485 to speak to a loan specialist directly. You can also submit your information using the form on our website and wait for a loan specialist to get in touch with you.

- Get a free quote. Your loan specialist will need some information about your vehicle to prepare your free quote. Be prepared to provide your vehicle’s make, model, year, mileage, condition, and trim level. Then, review the terms of your free quote with your loan specialist.

- Finalize your loan. If you’re happy with the terms of your quote, finalize your loan by signing and submitting the required documentation. Your loan specialist will guide you through this step to ensure you understand what needs to be signed and submitted.

- Collect your cash. Your money will be available shortly after your application is processed and approved. Pick up your cash in person or have it sent to you via check or wire transfer.

The title loan application process is simple and straightforward. The sooner you start your application, the sooner you can get the cash you need to make ends meet.

HOW MUCH IS MY CAR WORTH?