I Really Needed a Big Tax Refund This Year…But I Didn’t Get It. Now What

By carloansadmin • February 14, 2019

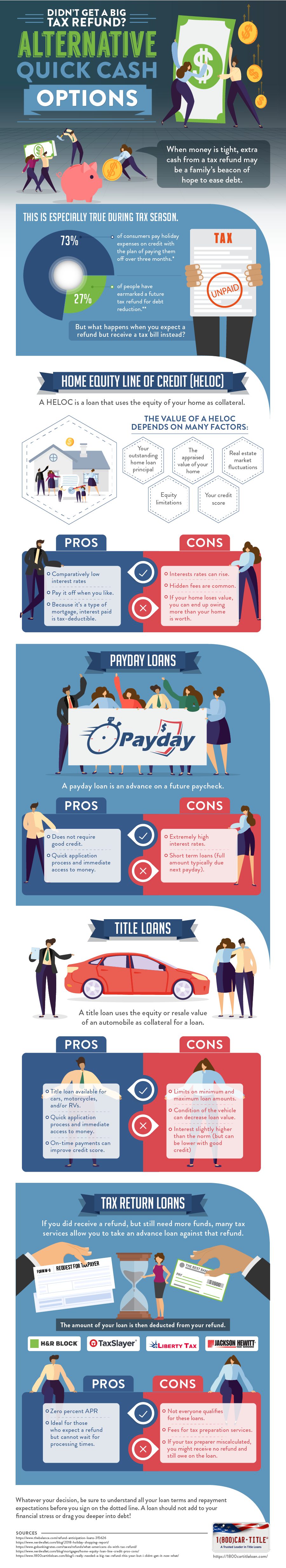

For many families and individuals, filing a tax return leads to a refund. For others, though, that year-end return means writing a check instead of receiving money back. No tax filer should ever bank on a refund, but unfortunately, underpayments are a reality.

Adding insult to tax injury is the fact that January and February often usher in bills from holiday spending. The time has come for families to pay the credit card debt that accumulated to ensure a happy holiday season. According to Nerdwallet’s 2018 Holiday Shopping Report, pulling out the plastic was the planned payment method of choice for 73 percent of consumers. Most of these consumers weren’t naive about how long it would take to pay off those charges, either. Nerdwallet’s report noted that, per the respondents’ estimations, clearing off holiday debt would take some time—more than three months, in fact.

When money is tight, an infusion of extra funds from a tax refund may often be a family’s beacon of hope to ease their debt. According to a survey from GoBankingRates, 27 percent of respondents have earmarked their future (or hopeful!) refund for debt reduction.

What happens, though, when you expect a refund but receive a tax bill instead?

If you were expecting a big tax refund to pay off holiday debts or other unexpected expenses, having to make another payment can be a devastating blow to your finances. Even if you don’t get a tax bill, a smaller refund than expected can still pack a punch. Holiday bills are looming overhead, and credit card companies are expecting their payments.

Now is the time to look into other financing options.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (or HELOC) is a loan that uses the equity of your home as collateral. So what is equity? The equity of your home is the difference between the outstanding loan principal and the appraised value of your home (basically, what you can sell it for on the market). Equity value can change over time and with the flux of the market. Paying down your mortgage principal can help increase equity, and the state of the real estate market can affect it, too (for better or worse).

Home values depend on many factors, and each real estate market may be different. However, if you’re interested in pursuing a HELOC, you need to talk to your bank or lending institution. Some homeowners apply for a HELOC with their current mortgage lender; others use a different bank or lender. Your credit score may affect the terms of your loan and the interest rate you can secure. Your loan also is based upon the equity limitations, so don’t expect an unlimited line of credit.

When you take out a HELOC, you are borrowing against the equity in your home, which could impact your finances if you need to sell your home in the near future. If you max out the equity in your home, selling could get complicated. So before you sign on the dotted line, make sure you understand the terms of your HELOC. This includes interest rates, any loan constraints, and the credit limit tied to your equity. Talk to your lender if you have any questions or concerns.

Payday Loans

Taking an advance on a future paycheck also can be a way to access money now. Payday loans allow consumers to receive money before their next payday by using the upcoming paycheck as collateral. Payday loans typically include a fee for the advance and the full amount is then owed when the paycheck is received.

There may be borrowing thresholds that limit the minimum or maximum borrowing amounts. Guidelines for these loans also may vary by state. Understand all the fees associated with these loans as well as repayment expectations. Payday loans are meant to be a short-term solution; be sure to talk to the lender if you have any questions about these loans.

Title Loans

The equity in your car also may help secure emergency money. Title loans use the value of an automobile as collateral for the loan. Like payday loans, they are meant to be short-term solutions. While interest rates vary, they are typically higher than traditional loans. Individuals with poor credit may qualify for a title loan, but the interest rate may be even higher because of the credit risk.

There may be limitations on the minimum and maximum loan amounts. These amounts may be guided by state regulations and/or the lender. Recreation vehicles (RVs) and motorcycles also may be used for these loans, but, again, the loan value may be capped.

Loan amounts also are limited to the equity or resale value of an automobile. And there are many factors that affect the value of a car, truck, van or SUV. Age, condition, make/model, and mileage all can increase or lower the value. The title of the automobile also has to be ‘clean.’ A salvage title cannot be used for a title loan.

Always review the terms and conditions of your loan so you understand the APR and payment expectations. Again, title loans are meant to be short term solutions to a financial need. Those who already have a title loan but may be struggling to make payments because of high interest rates also can investigate refinancing the loan. Better terms may lead to lower payments.

Tax Return Loans

If a tax return shows a refund, you may be able to take an advance loan against that refund. H&R Block offers these loans. According to the H&R Block web site, there is a zero percent APR for these loans. And once your refund is received, the amount of your loan is deducted from your refund. They can also be taken via Refund Transfer (although H&R Block notes that this choice is optional). Consumers may choose how much of an advance they need; amounts range from $500 to $3000. However, be aware that not everyone may qualify for these loans.

This type of loan may be an ideal solution for those who are expecting a refund but cannot wait for the IRS to process their return (and deposit the refund). And H&R Block isn’t the only option; according to the Detroit Free Press , TaxSlayer, Liberty Tax, and Jackson Hewitt offer similar loans.

While many families are hoping for a massive refund this tax season, not all filers will get good news on their return. For those who aren’t getting a large refund, there are options when finances are tight and holiday bills are busting the budget. A HELOC, payday loan, title loan or refund advance may be an option to help pay for unexpected expenses and/or credit card bills from holiday spending. Before you sign on the dotted line with any lender, though, be sure you understand all the loan terms including your annual percentage rate and repayment expectations. A loan should not add to your financial stress or drag you into deeper debt.

More Resources

- Online Car Title Loans

- Apply to Refinance Your Title Loan

- Title Loan Quote

- Car Title Loans in California

- Great Title Loans in Georgia

- This is How Title Loans Work

- Get Fast Cash in Utah

- Homepage

- What is a Pink Slip Loan?

- Old Car? Can I get a Title Loan?

- Get a Title Loan in Sacramento

- Get a Loan in St Louis

- Car Title Loans in Fresno

- Service Projects

- Arizona

- Title or Payday Loan?

- Options

- Can I Improve my Credit with a Loan?

- Prestamos de Titulo

- Use Your RV to get a Loan

- Salt Lake City

- Bakersfield

- Idaho

- Get Your Loan with Moneygram

- Car Title Loan Programs

The post I Really Needed a Big Tax Refund This Year…But I Didn’t Get It. Now What appeared first on (EN) 1(800) Car-Title®.

HOW MUCH IS MY CAR WORTH?