How To Save Money on your Monthly Car Expenses

By carloansadmin • December 7, 2018

Your car is one of your most valuable assets, but its value isn’t strictly about monetary gain. Cars decrease in resale value each year—maybe even each day. Your car’s value, though, is beyond money. Your car is your ticket to freedom and independence. For many individuals, that ride is one of life’s biggest necessities. Our automobiles get us to work, to appointments, to the grocery store. Without a car, most of us would be forced to live our lives very differently.

Yet, a car can be one of our biggest expenses each month. According to AAA’s 2017 Your Driving Costs , the price of owning a small sedan (including gas, insurance, registration, etc.) is estimated to surpass $6,000 a year (or more than $500 per month). For many consumers, owning a car isn’t an option—it’s a necessity—and the price of ownership can be budget-busting.

While car expenses can easily chip away at monthly income, you can try to keep ownership costs under control. Being frugal with finances, however, does not mean neglecting your ride. To ensure a car’s safety and its dependability, you must invest in routine mechanical check-ups, tire rotations, oil changes, and more. Remember, your car is an investment.

While a vehicle’s monetary value might decrease, your reliance on your car remains the same and this reliance makes your car one of the most priceless possessions you own.

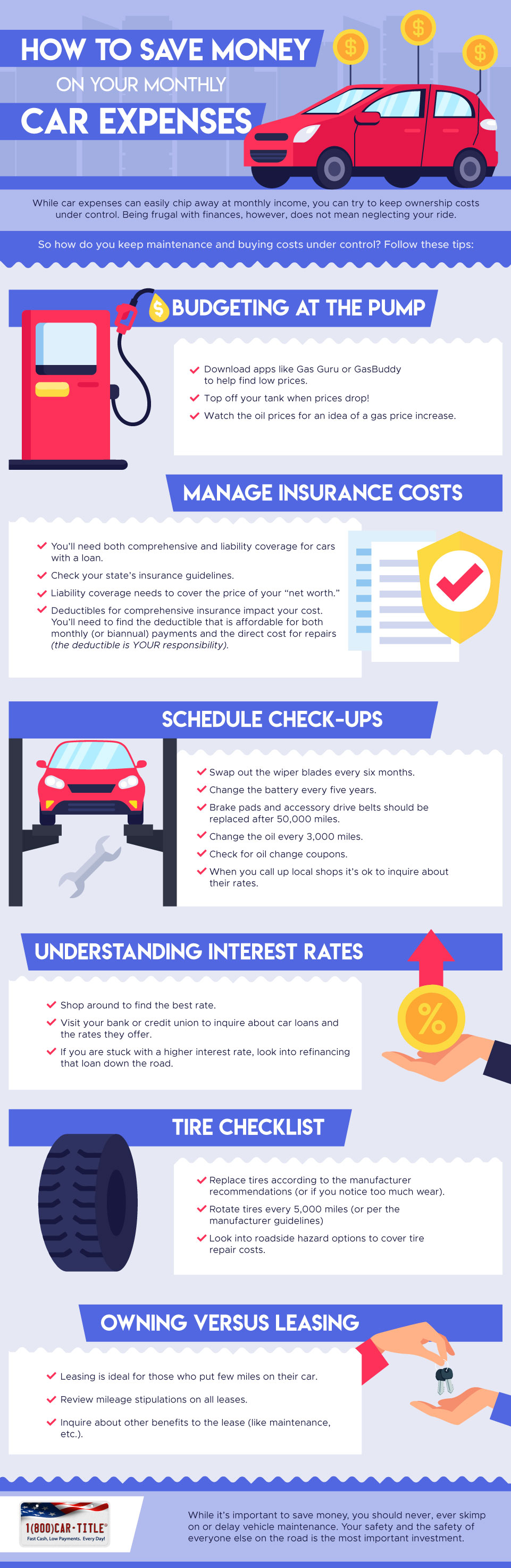

So how do you keep maintenance and buying costs under control? Here are some tips on how to save money:

Guzzling Gas

The price of gas is dependent on the market value of oil. As oil prices soar, gas prices also elevate. But some areas may offer lower prices than others near you. Why? Taxes and competition may come into play. According to ExxonMobil : “A suite of federal, state, and local taxes can add any where from 30 to 70 cents per gallon to your bill….” Bankrate offers a map of taxes per state , and it’s easy to visualize how those taxes affect the prices from coast-to-coast.

When you want the cheapest prices at the pump, you might need to shop around. See the price drop? You may want to top off the tank. Waiting around could mean higher prices. While you want to seek out the lowest prices for gas, you also don’t want to drive around wasting gas just to find cheap gas. To find the lowest prices in your area, use apps like Gas Buddy and/or Gas Guru.

Budgeting At the Pump

- Download apps like Gas Guru or GasBuddy to help find low prices.

- Top off your tank when prices drop!

- Watch the oil prices for an idea of a gas price increase.

Insurance Costs

Driving that car on the road means you need insurance to cover your liability and your vehicle. If you don’t own your car outright, you’ll need both liability and comprehensive automotive insurance. You also should research coverage that protects you against uninsured motorists. Some policies also include other options like roadside assistance. Review all your options to find the coverage that works for you.

So, what’s the difference between comprehensive coverage and liability coverage?

A comprehensive policy covers your own vehicle in cases like hail, acts of vandalism, etc. A comprehensive policy will provide a financial resource to help you fix your vehicle. With comprehensive policies, you will need to select a deductible–this is the portion of the costs that remains your responsibility (it’s typically deducted from a claim payment). Lower deductibles will likely result in higher monthly premiums, while a high deductible won’t be as costly…until you need to pay for repairs (then that high deductible may really hurt). Your deductible should be a price that is manageable for you–in regards to both monthly payments and a bottom-line related to repair costs.

Liability insurance covers your liability in case of an accident. This typically pays for bodily injuries, damaged property, etc. But insurance policies are different in their coverage. So how much liability coverage do you need? According to Nerdwallet ,“the more you own, the more liability insurance you should have.” Why? You need to cover your assets in case of an accident. The site notes that you should total all your assets (home, car, investments, etc.) and then subtract your debts. This will show you your “net worth.” And that’s the number that will help you set the coverage needed for injuries (noted as “bodily injury”).You’ll also need coverage for property damage, etc. Look at your state regulations for liability insurance, but make sure you protect your assets. Talk to your insurance provider if you need advice on coverage.

Insurance Checklist

- You’ll need both comprehensive and liability coverage for cars with a loan!

- Check your state’s insurance guidelines.

- Liability coverage needs to cover the price of your “net worth.”

- Deductibles for comprehensive insurance impact your cost. You’ll need to find the deductible that is affordable for both monthly (or biannual) payments and the direct cost for repairs (the deductible is YOUR responsibility).

Schedule Check-Ups

Once a year, you typically head to your doctor’s office for a physical, right? (Or you try.) Taking care of your car’s health also is important. Routine check-ups ensure your car’s mechanics are on-par. Some states require yearly or biennial safety inspections, and you also should have your mechanic do a quick check-up whenever your car is in for basic maintenance–like an oil change or tire rotation.

Keeping up with proper maintenance helps improve the health of your car. So what do you need to anticipate replacing, changing or updating? And when should you expect for those repairs to occur?

According to Real Simple, wiper blades need to be swapped out every six months (or at least once a year).You do NOT want to be caught in a rainstorm with dull wiper blades! And that car battery? Real Simple says that the battery needs to be swapped after five years and that brake pads and accessory drive belts should be replaced after 50,000 miles. Your car’s transmission also is not to be ignored. Look to your owner’s manual to find the recommendation for changing the transmission fluid.

You also may need to have the transmission flushed every 30,000 miles (or every other year, whichever comes first). There are many other items that also will need to be replaced, changed or updated; always talk to a mechanic about any services your car may need now…and in the future. You may even want to create a car calendar outlining your past services and future services so you can keep track of all those maintenance needs. Because as a car ages, things begin to wear down and break down.

Don’t forget to schedule regular oil changes.

Typically, you should change the oil every 3,000 miles—although some cars require less frequent changes. Always read your car’s manual to find out when you need to change the oil; different makes and models have different needs! Don’t wait until the light goes on! Between oil changes, check oil levels regularly. Some cars burn oil quicker; low oil will wreak havoc on your engine. If that level falls too low, the engine will cease !

Budgeting Maintenance

But, wait! Aren’t all these maintenance checks pricey? Not necessarily. Many oil change shops offer coupons if you sign up for their mailing list. As for wiper blades and batteries, you can buy those at big-box stores like Walmart. Before you buy basic parts, though, price hunt! And be sure to have a professional install items and parts (although, you should be able to pop on your own wiper blades).

You should never delay or skimp on services or safety. If something needs to be fixed, repaired or replaced, fix it and don’t ever wait to schedule your appointment—safety first! When you call up local shops to schedule your service appointment, it’s ok to inquire about their rates. While you want a good price, though, don’t spend time shopping around when you need repairs. The shop availability needs to be your number one concern.

Don’t assume that cheaper is better. If you like your local mechanic—but he or she is a little more expensive—stick with them…they know your car and you. Having a good relationship with your mechanic also may save you in the long run; they can advise you about when to schedule the next tune-up and give you other tips to keep your car in great shape!

Interest Rates: Aim Low

Do you know what really impacts the price of your car payments each month? Interest rates! If you bought your car—or are looking to buy a car—the interest rate will directly affect your monthly payment. For those with poor credit, interest rates will be higher as this affects your lending risk. But no matter what your creditworthiness, shopping around is always the best idea.

You may be able to secure a loan through your dealership, but don’t say “yes” to the first offer. Instead, visit your bank or a local credit union to inquire about their loan rates. You may find that you can secure a lower interest rate elsewhere. And every percentage point helps when you’re trying to cut costs! You can even take a look at online auto loan providers.

Understanding Interest Rates

- Shop around to find the best rate.

- Visit LoanCenter.com to inquire about car loans and the rates they offer.

- If you are stuck with a higher interest rate, look into refinancing that loan down the road!

Don’t Fall Flat

Let’s not forget to talk about tires! You can’t go anywhere safely if those treads are worn and ragged. Replace your tires according to the manufacturer’s guidelines. But if you notice that your tires are looking worn, replace them sooner.

Rotating your tires also is important to ensure equal wear. So, what is a tire rotation? This just means that the tires are repositioned depending on where your tires are most worn out. How often you rotate your tires may depend on the manufacturer. However, the general recommendation is to rotate tires about every 5,000 miles. To make it easier, just request a tire rotation at each oil change.

How can you save money on rotations and tires? Some of the best tire prices may be found at big-box stores. Other businesses specialize in tires and may offer many varieties across all price points. Some shops may even offer a discount if you buy four tires at once. Just be sure to buy the type of tire your car demands; if you are unsure about what to buy, speak with a mechanic.

Many stores will offer you a warranty program for “roadside hazard.” This means that for an added price, the store may provide free repairs or rotations and may even prorate your tires if you need are placement sooner rather than later. Are these programs worth the price? That depends on you. If you have a habit of hitting curbs and popping your tires, you may save money with this option. But if you know how to repair your own tires or you don’t feel like the added extra is worth it then just say no.

Tire Checklist

- Replace tires according to the manufacturer recommendations (or if you notice too much wear).

- Rotate tires every 5,000 miles (or per the manufacturer guidelines)

- Look into roadside hazard options to cover tire repair costs.

Owning versus Leasing

Do you have to own your vehicle to get the best deal? Not necessarily. One of the best ways to save money on your car is to investigate a lease option. Your monthly payments will be, typically, lower and you’ll save money on some routine car care—as it’s built into the lease. But there also is a downside to the lease option: mileage constraints. Leasing is great if you don’t put much mileage on your cars, but if you like to take road trips or if you have a long commute, leasing could be cost-prohibitive. Mileage constraints on that lease could be as low as 10,000 miles per year. And any extra miles are typically billed on a per-mile fee (and that could add up quickly!).

So while the monthly payment is lower, be sure to read the mileage details and make sure you know exactly what the lease stipulates.

Leasing Checklist

- Leasing is ideal for those who put few miles on their car.

- Review mileage stipulations on all leases.

- Inquire about other benefits to the lease (like maintenance, etc.).

You need to ensure that your car remains in great shape, so budget those expenses to save a little money. Shop around for mechanics, compare prices, and decide on a car care team that will work for you. Always remember that tune-ups, new tires, tire rotations and routine maintenance also ensure your safety on the road.

While it’s important to save money, you should never, ever skimp on or delay vehicle maintenance. Your safety and the safety of everyone else on the road is the most important investment.

More Resources

- Apply Online Now

- Title Loan Refinancing

- How Much Can I Get?

- Get Cash in California

- Get a Title Loan In Georgia

- Car Title Loans

- Title Loans in Utah

- 1(800)Car-Title-Loans

- Pink Slip Title Loan

- Get a Title Loan with an Old Car?

- Sacramento

- St Louis

- Get a Loan In Fresno

- Our Service Projects

- Find a Title Loan in Arizona

- Should I Get a Title Loan or a Payday Loan?

- What are My Title Loan Options

- Improve Your Credit with Title Loans?

- Se Hable Espanol

- Collateral Loans on your RV

- Get a Loan in Salt Lake City

- Get a Loan in Bakersfield

- Get a Loan in Idaho

- We’re Partners with Moneygram

- Different Programs

The post How To Save Money on your Monthly Car Expenses appeared first on (EN) 1(800) Car-Title®.

HOW MUCH IS MY CAR WORTH?